When running an insurance agency, you can’t rely on your gut instinct all the time. You should be objective and disciplined when determining the financial health of your agency.

One way to objectively track the health of your business is through key performance indicators, otherwise known as KPIs. KPIs are metrics that can help you chart progress towards a variety of business goals — from revenue, to profit, to marketing investments.

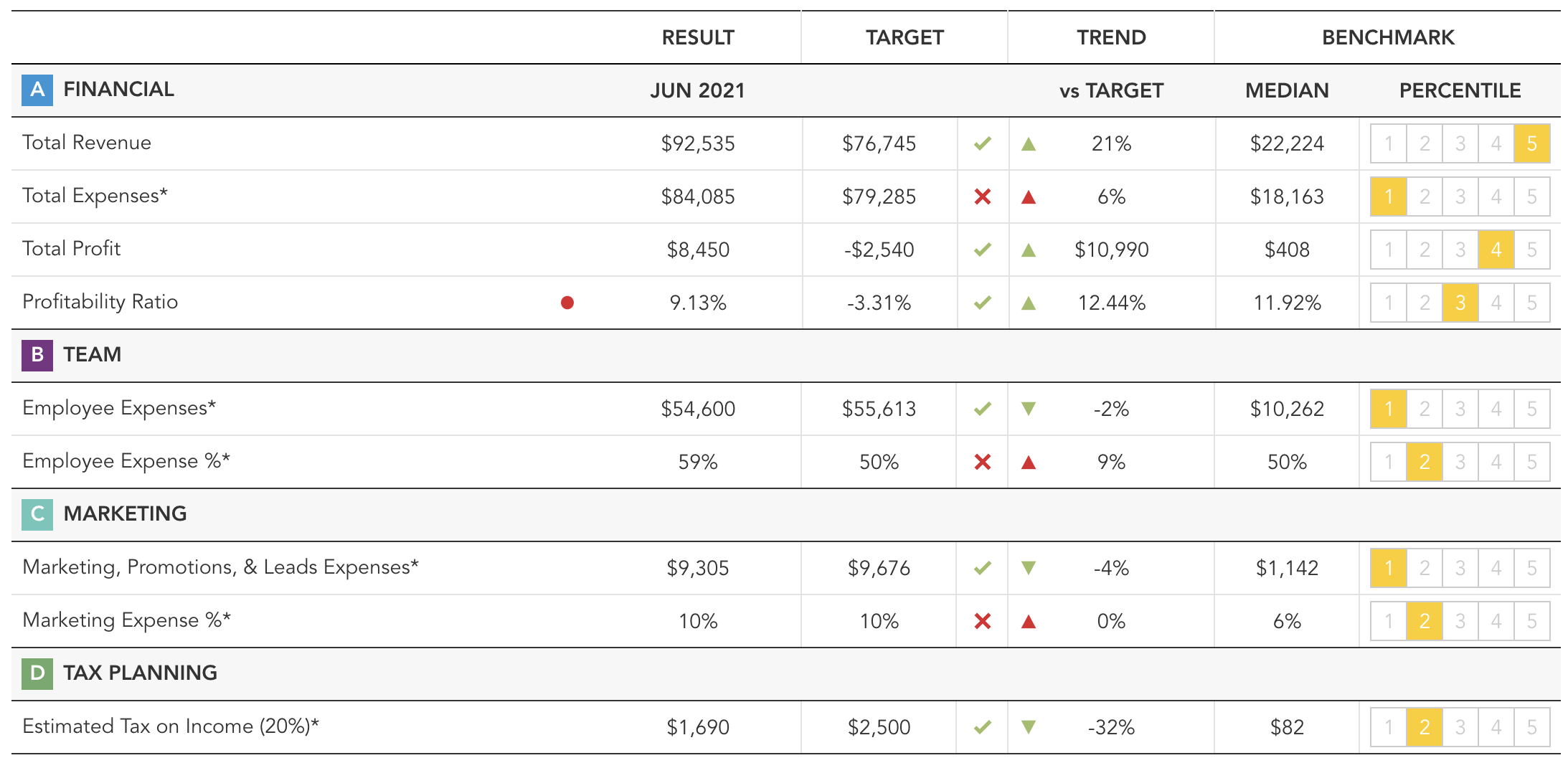

Keeping close tabs on your agency's financial performance is essential to long-term success. Through Club Capital's KPI Dashboard you're able to:

- View your KPIs at-a-glance with updated data every month and refreshed data every night

- Trend your KPIs over time

- Compare your KPIs to your targets

- See how your KPIs compare to your Insurance Agency Peers

- Select the appropriate benchmark group that allows you to compare to everyone across the country or narrow it down to tenure or revenue category

After working with hundreds of agencies across the country to help scale their business, we've identified the Top 9 Financial KPIs that will help you measure your agency's financial health and fuel your growth.

Club Capital's New KPI Dashboard w/ The Top 9 Financial Metrics:

1. Revenue - a measure of the total revenue received or reported by your agency or carrier(s) for the given period

2. Expenses - a measure of the total expenses incurred by the agency during the given period

3. Profit - a measure of the total profit generated by the agency for the given period (Revenue minus Expenses)

4. Profitability (%) - when used as a percentage, this is an efficiency measure for your agency. A larger value here not only equated to a larger profit amount, in dollars, but shows how efficient your Agency is with the expenses needed to generate income. This is a great measure to compare to other Agencies across the country because comparing dollar to dollar is always going to be different.

5. Employee Expense ($) - a measure of all of the expenses related to your employees that was incurred during the given period. This includes base salaries, commissions, payroll taxes, benefits, and any expenses related to appointment or termination.

6. Employee Expense (as % of Revenue) - The percent of revenue spent on all employee related expenses for the given period. When used as a %, this helps establish thresholds to stay below as well as helps in comparing to industry averages using Club Capital's "Compare Tool."

7. Marketing Expense ($) - a measure of all of the expenses related to your agency's marketing and promotion events that was incurred during the given period. This includes SEO, leads vendors, events, expenses for referrals, and general branding initiatives that your Agency is taking.

8. Marketing Expense (as % of Revenue) - The percent of revenue spent on all marketing related expenses for the given period. When viewed as a % of revenue, this helps establish general benchmarks to achieve, or not go over. This is also a great way to help compare to industry averages using Club Capital's "Compare Tool."

9. Estimated Tax on Income - this is the amount that we would recommend saving for your personal income taxes for a combination of both federal and state. This is a direct correlation to the profit of your agency.

Club Capital is the largest accounting and advisory firm for insurance agency owners in the country providing a one-stop financial infrastructure including monthly accounting, integrated payroll, CFO services, and tax preparation.

For more information on Club Capital services you can book a demo with our team or reach us at 240-219-9200.

Comments