Understanding your cash flow doesn’t need to be complicated, and being on a cash accounting basis here at Club Capital makes understanding the Cash Flow Statement even easier. At its core, cash flow is about tracking money coming into and going out of your business. In this blog, we’ll walk through a simple approach to understanding your Cash Flow Statement using an example that highlights the main elements affecting your cash.

The Basics of Cash Flow

Your cash flow boils down to three possibilities:

- Cash is coming into your pocket.

- Cash is going out of your pocket.

- There’s no change in cash.

A formal Cash Flow Statement might look complex, but it’s simply a record of how cash moves within your business over a period. The example below demonstrates how changes in your Balance Sheet impact your Cash Flow Statement.

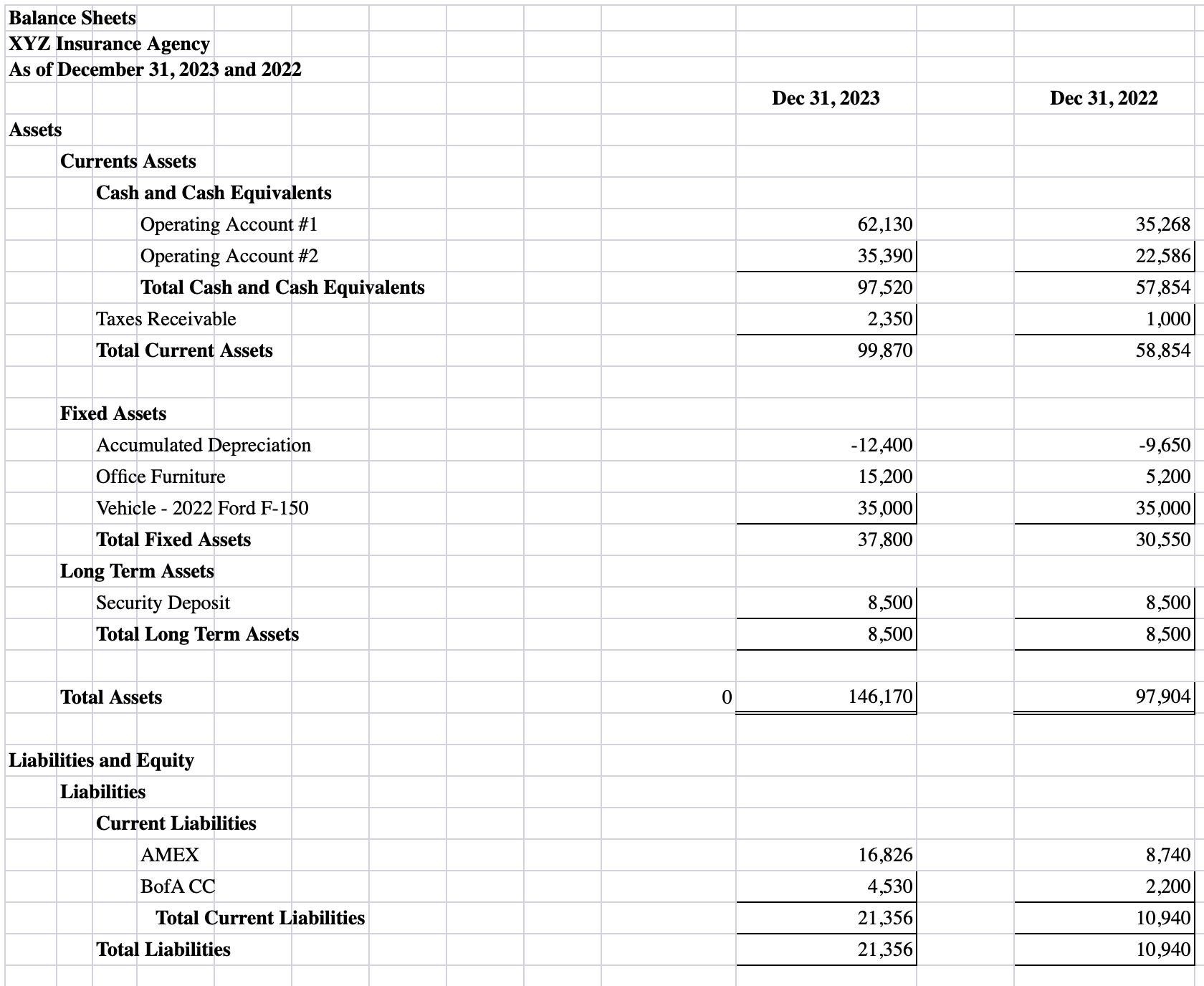

Here is an example Balance Sheet:

Here is an example Cash Flow Statement:

Balance Sheet Connection

Consider the Balance Sheet for XYZ Insurance Agency as of December 31, 2023, compared to December 31, 2022. At first glance, it might seem like changes in your financial statements are too complicated to decipher. But, in reality, they’re straightforward when you break them down.

-

Net Income Impact: If there were no changes in the Balance Sheet (other than the Net Income in the Equity section), the increase or decrease in cash for 2023 would simply be your Net Income or Loss. However, Balance Sheet account balances do change, and these changes directly impact your cash flow.

-

Asset Changes: If any asset account (current or long-term) increased in 2023, this would result in a net decrease in cash on your Cash Flow Statement. For instance, XYZ Insurance Agency purchased $10,000 worth of office equipment, leading to an increase in long-term assets and a corresponding decrease in cash.

-

Liability Changes: If any liability account (current or long-term) increased in 2023, this would cause an increase in cash on your Cash Flow Statement. Conversely, if liabilities decreased, such as paying down $20,000 on a truck loan, cash would also decrease. For XYZ Insurance Agency, increases in current liabilities like AMEX and BofA CC contributed positively to cash flow.

-

Depreciation/Amortization: Certain items, like depreciation and amortization, increase the balance in your accumulated depreciation but have no effect on cash. These non-cash expenses are added back to your net income in the Cash Flow Statement to reflect the actual cash position.

What Impacts My Cash Flow?

Let’s consider two scenarios that directly affect cash flow:

- Buying $10K of Furniture for Cash: When XYZ Insurance Agency purchased furniture, it increased its long-term assets by $10,000. This transaction reduced the cash balance by the same amount on the Cash Flow Statement.

- Paying Down $20K on a Truck Loan: By paying down a loan, the agency decreased its long-term liabilities, which also reduced cash by $20,000.

Equity Section Impact:

Changes in the Equity section of your Balance Sheet also influence cash flow. For example, if any of the Owners’ Equity accounts increased in 2023, this would result in a decrease in cash (and vice versa). Distributions taken by the owners decrease cash without affecting Net Income. It’s as simple as understanding that taking money out reduces what’s left in your pocket.

Operating Activities:

Operating activities are the day-to-day business transactions that affect your cash flow. For XYZ Insurance Agency, the net income was $77,880 for 2023. When adjustments are made for non-cash expenses like depreciation ($2,750) and changes in working capital (such as a $1,350 decrease due to a tax receivable), the Cash Flow from Operating Activities totals $89,696.

Investing and Financing Activities:

In the Cash Flow Statement, investing activities like the purchase of office equipment for $10,000 are shown as a cash outflow, reducing the overall cash position. On the other hand, financing activities might include changes in loans or equity that further impact your cash flow.

The Keys to Understanding Your Cash Flow Statement

Understanding your Cash Flow Statement is straightforward when you link it to changes in your Balance Sheet. Each line item either puts cash back in your pocket, takes it out, or leaves it unchanged. By focusing on these connections, you can get a clear picture of your business’s cash flow, enabling better financial decisions.

Remember, the key is to keep it simple: money in, money out, or no change at all.

Club Capital Supports Your Cash Flow Management!

If you're ready to see how bookkeeping, tax preparation, and financial strategy (CFO Services) can support your cash flow growth and management, book a call to see how we can partner with you. Click here to find a time that works for your schedule.

Comments