We have all heard about the new tax reform law that went into affect in 2018 but now that we've put our 2017 tax year behind us, do we actually know how the new tax reform is going to affect our business? Outside of the reduction in corporate taxes, one of the most referenced areas of the new tax law for small businesses is the impact it has to Meals, Entertainment, and Travel related expenses. Or does it?

We need to throw out the basic rule that you can claim expenses as long as they are business related. Even prior to the new tax law active in 2018, there were some business related meal and entertainment expenses that were 50% deductible vs. 100% deductible.

The new tax act established additional limitations on the deductibility of certain business meals and entertainment expenses.

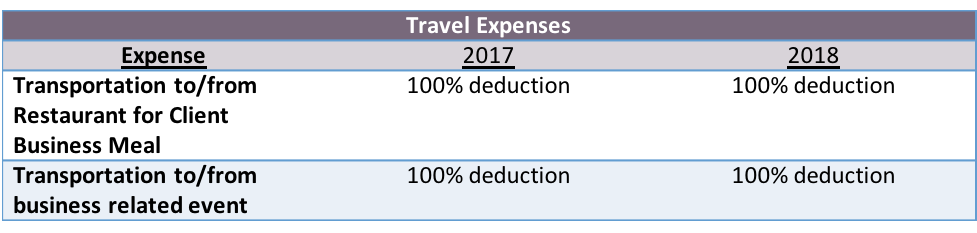

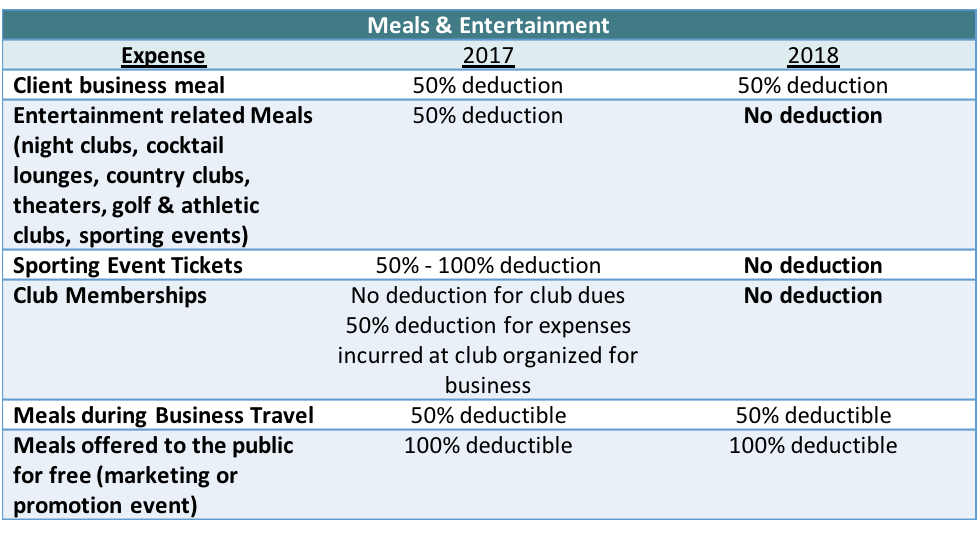

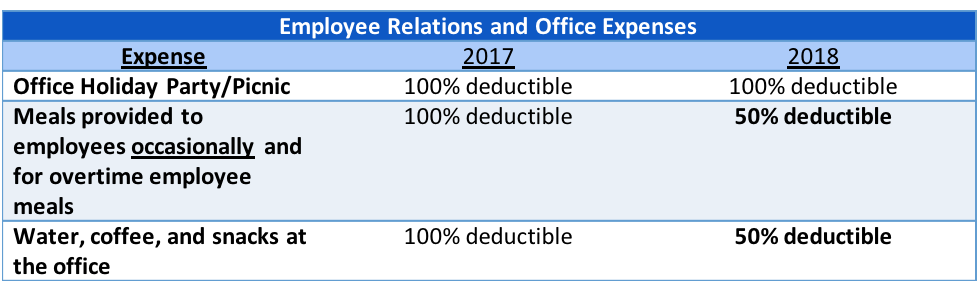

The way the tax law reads, some of the expenses small businesses are used to will remain the same, but a number of them - even those that we tend to think fall outside of the typical "meals & entertainment" category - are changing. To try to make sense of this, we've broken out the typical types of expenses across three categories:

- Travel

- Meals & Entertainment

- Employee Relations & Office Supplies

Review the charts below to see how your business expenditures will be affected this year and reach out to your Club Capital accountant (or your financial advisor) for more specific questions.

SO WHAT NOW?

How does this affect my agency's financials? Should I conduct my business differently?

Your agency's financials (i.e. your Income Statement or P/L) will change if you've incurred expenses that are no longer qualified deductible expenses in the 2018 tax year. It is very likely that your agency's Chart of Accounts (as is the case with Club Capital) will need to be altered as each account should hold expenses that are treated the same when it comes to tax deduction classification.

As a general rule:

- Expenses that are 50% or 100% deductible: keep these expenses on a company bank/credit card.

- Expenses that are NOT deductible: these expenses are likely better spent through personal banks/credit cards.

- When these expenses are incurred through a business bank/credit card, your Club Capital accountant will treat these as an Owner's Draw from the business.

Have more questions? Feel free to reach out to us for more information.

DISCLAIMER:

Each financial situation is different. This advice is intended to be general. Please contact your financial or legal advisory for information specific to your situation. Please contact your financial or legal advisory for information specific to your situation.

Comments