The Tax Cuts and Jobs Act (TCJA) has plenty of good news for small businesses and their owners, including a very favorable first-year depreciation break for vehicles used for business....

Continue Reading

The Tax Cuts and Jobs Act (TCJA) has plenty of good news for small businesses and their owners, including a very favorable first-year depreciation break for vehicles used for business....

Continue Reading

After wrapping up the 2019 tax season, there were some consistent themes for questions and areas of clarification amongst our clients. One that we’ll talk about here today is the...

Continue Reading

We have all heard about the new tax reform law that went into affect in 2018 but now that we've put our 2017 tax year behind us, do we actually know how the new tax reform is going to...

Continue Reading

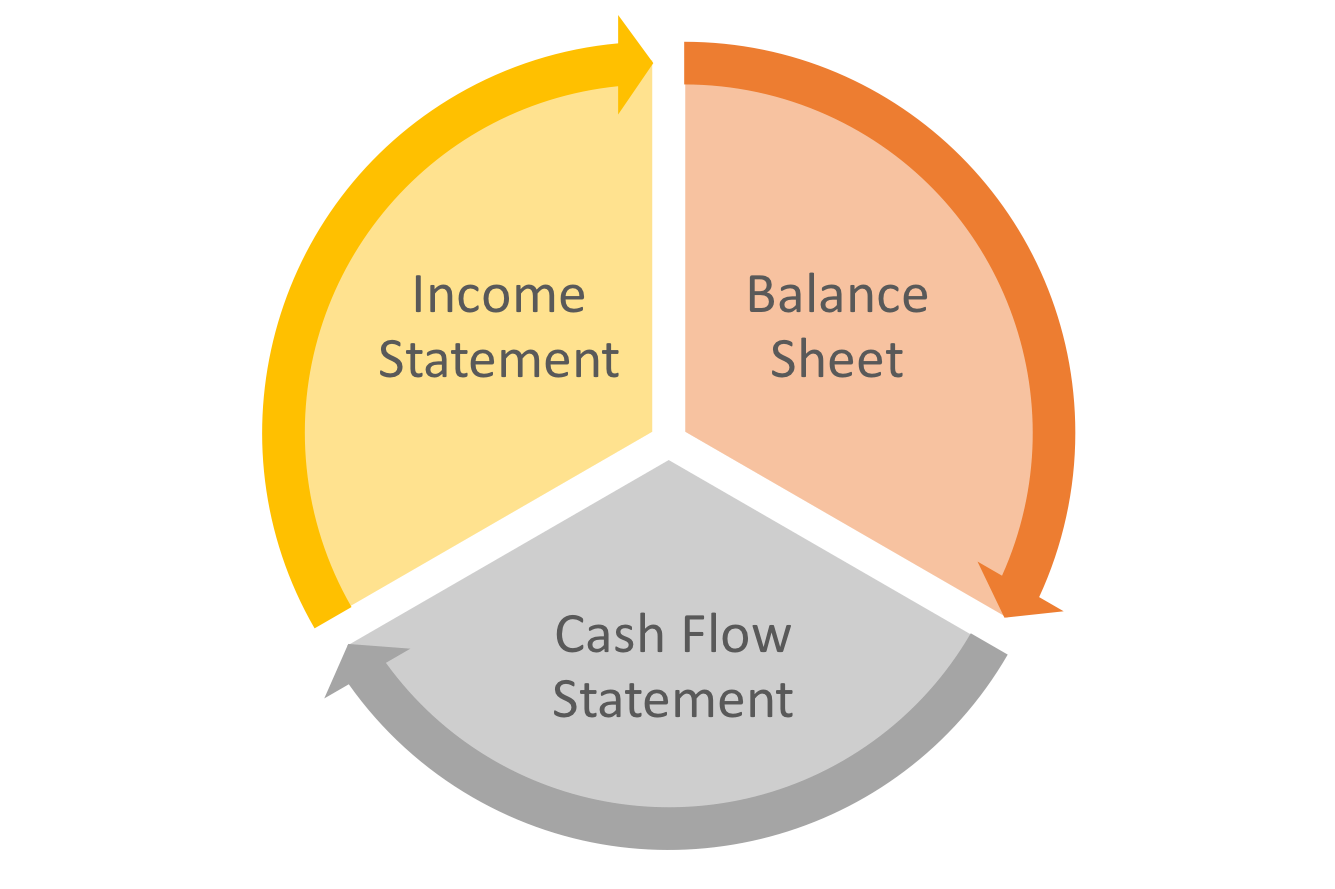

Does it seem like your agency is making less money than what your income statements are reporting? Having a hard time tracking where all your money is going throughout the month? While the...

Continue Reading

Are you incorporated? Do you have an LLC filing as an S-Corporation? Did you setup your S-Corporation as a pass-through entity? There has been a recent IRS ruling that impacts the way...

Continue Reading

A Review of the Tax Cuts and Jobs Act – What You Need to Know, Now. We've separated our recommendations based on the new tax reform law based upon taxes for individuals and taxes for...

Continue Reading

Did you know that some of your business meals are 100% deductible? No?! Well hopefully you know that the majority of your business meals are at least 50% deductible! If both of these are...

Continue Reading

We all want to mnimize our tax burden as much as possible, but there are some expenses that, while you think they might be for the business, they are absolute no-go's from an IRS...

Continue Reading